Sammamish Mortgage

Project Overview:

Sammamish Mortgage engaged us to redefine their digital ecosystem: redesign their website for optimal lead conversion, integrate custom mortgage tools for borrowers and loan officers, and launch targeted marketing campaigns to boost visibility and growth. The aim was to unify brand, marketing, and technology into one high-performing platform.

Sammamish Mortgage

Mortgage

2018

The Challenge

The client’s legacy website and toolset were outdated, under-performing, and poorly integrated. They struggled with conversion rates, bounce rates, and inefficient internal workflows. On top of that, real-time data integration for rates and loan limits was limited, which hindered user experience and responsiveness in a fast-moving mortgage market.

The Approach

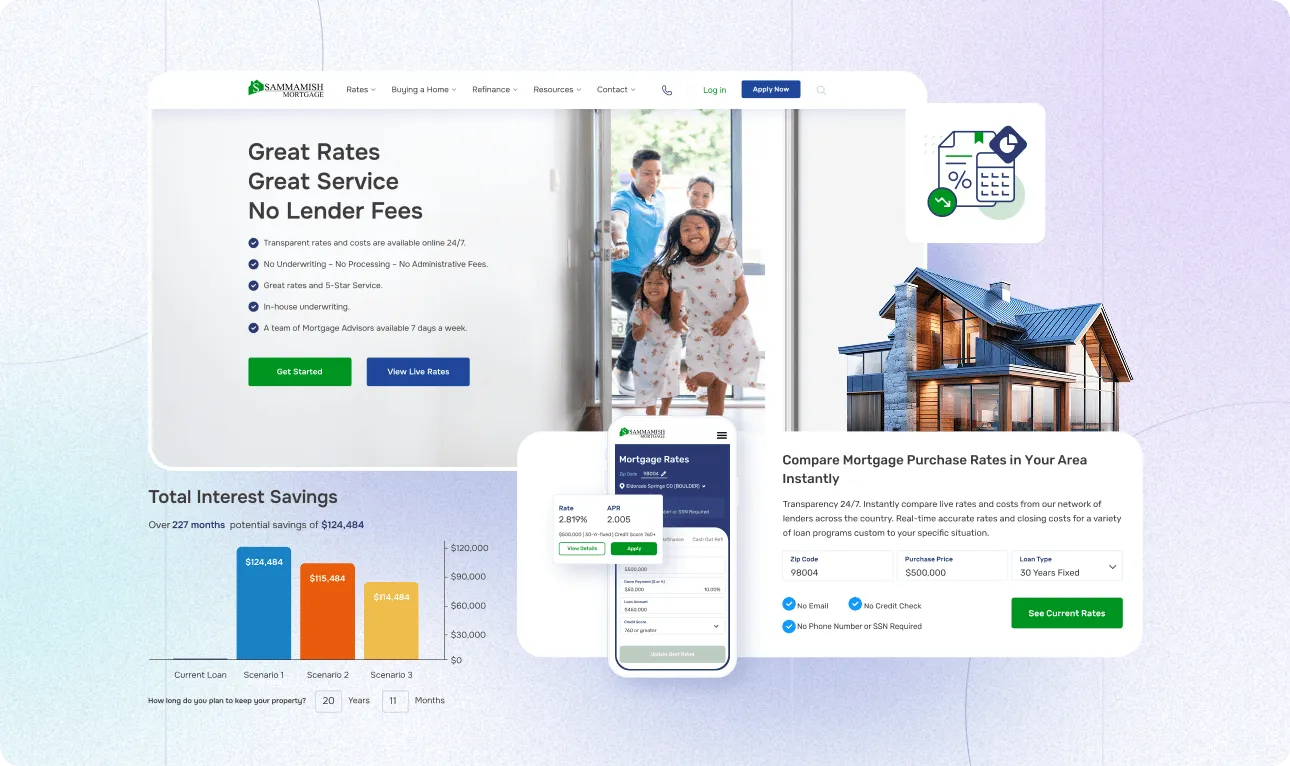

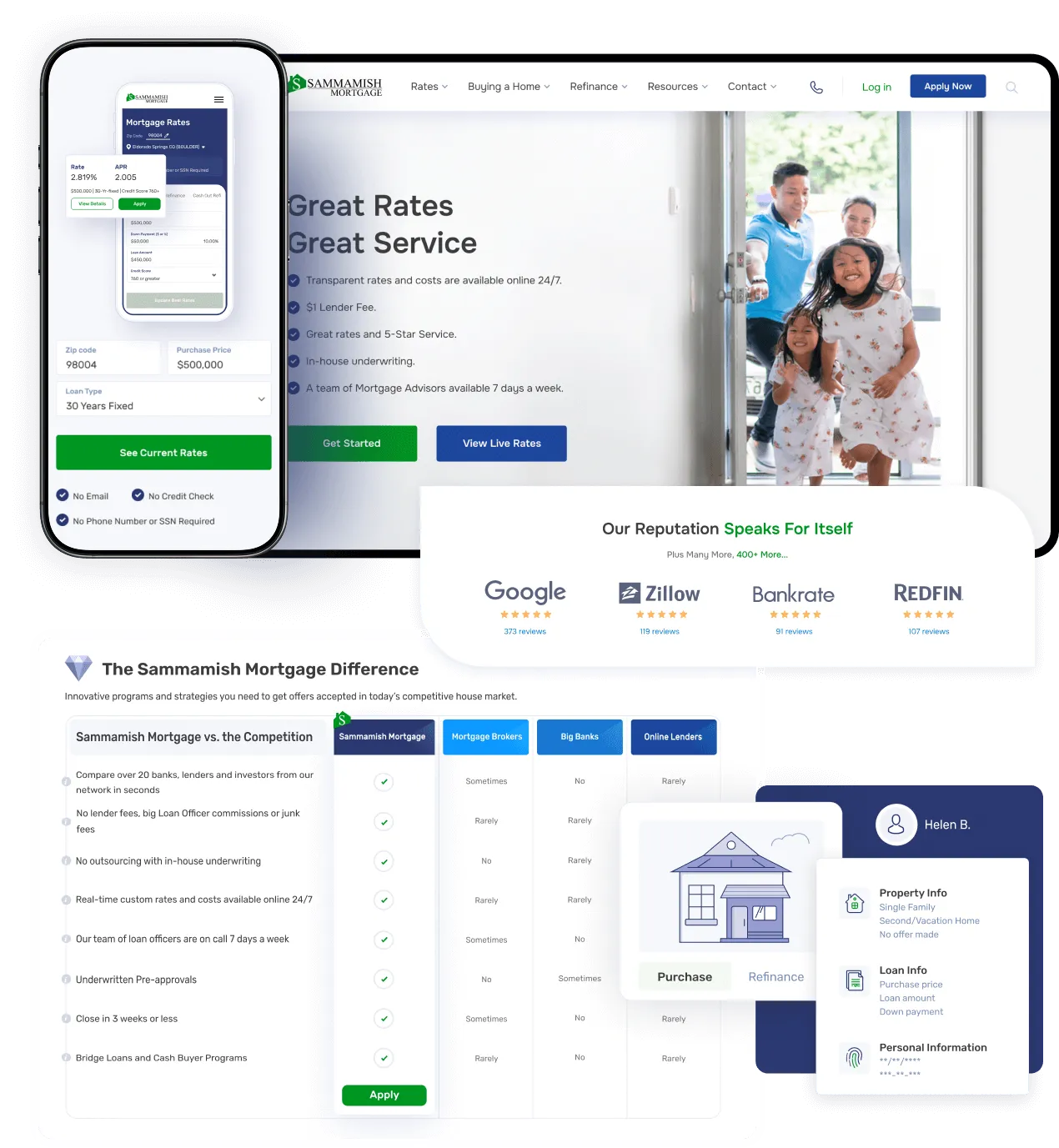

We redesigned the public-facing website with modern UX, mobile responsiveness, and clear conversion paths.

We built and integrated three proprietary tools: an Instant Mortgage Rate Quote engine, a geo-based Loan Limits tool, and an internal FlexCost Mortgage Dashboard for loan officers.

We complemented the tech build with marketing strategy and ad campaigns to drive qualified traffic and maximize ROI.

We ensured the system architecture supported real-time data feeds, seamless user flows, and ongoing scalability.

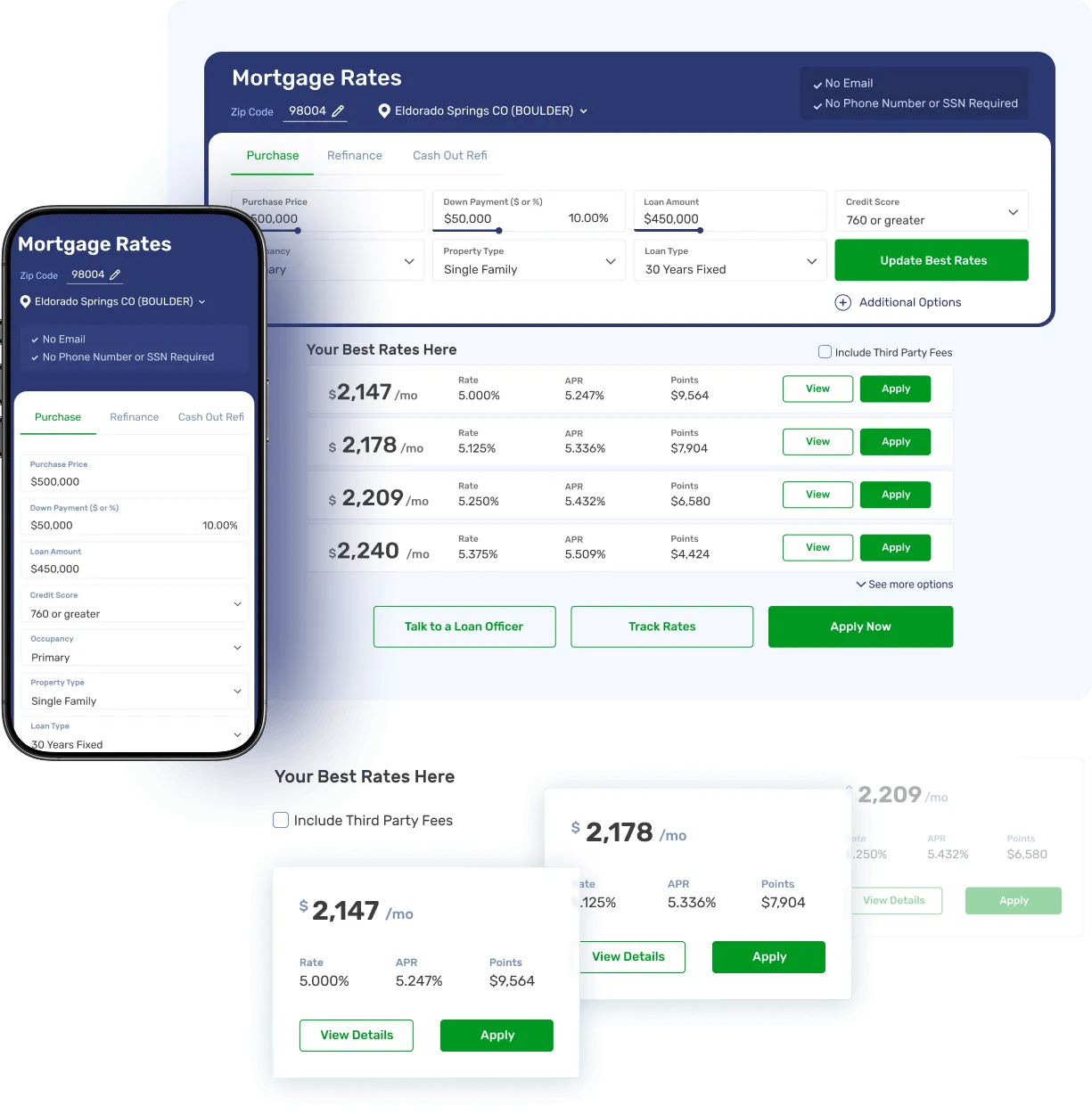

Instant Mortgage Rate Quote

A public-facing tool that uses live rate data to instantly quote users, capture leads, and support loan-officer follow-up.

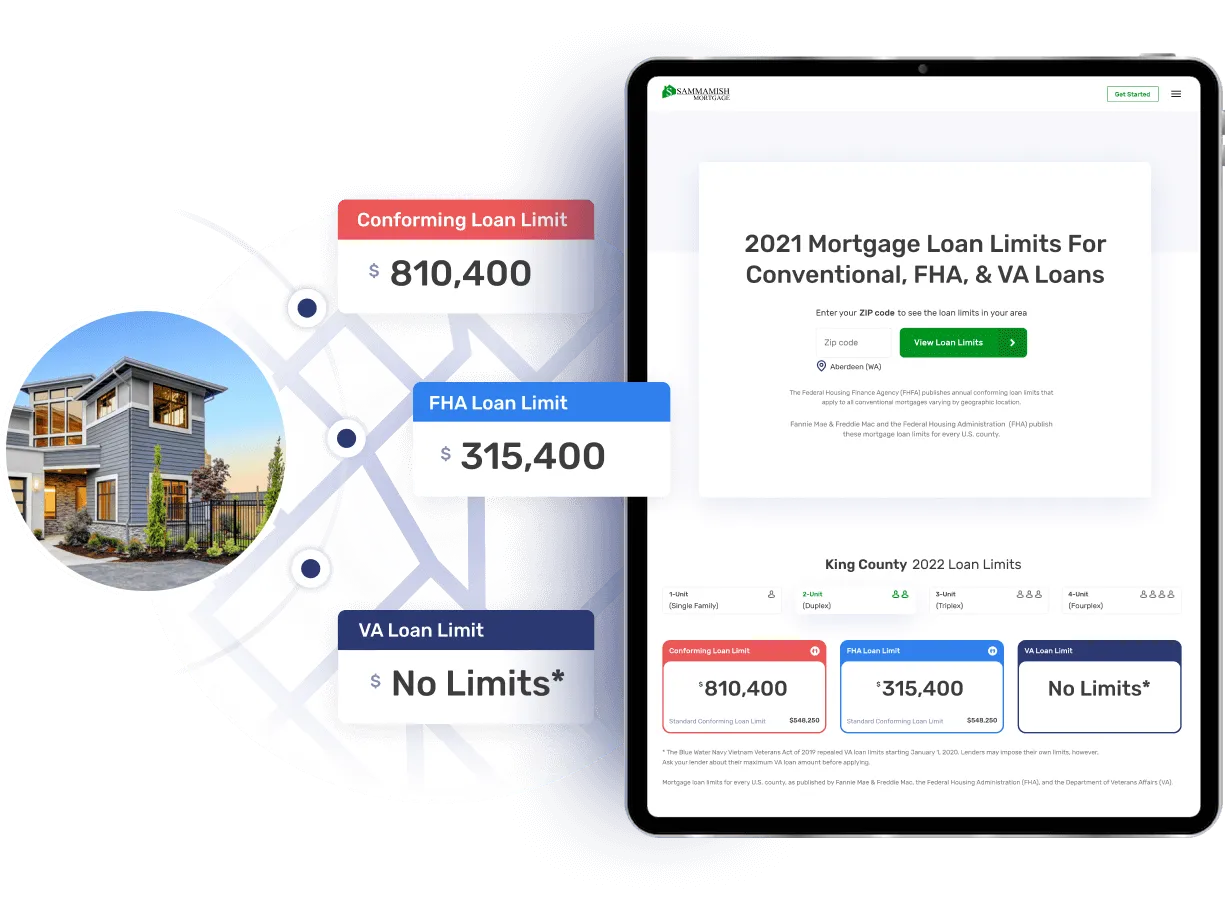

Loan Limits

Geo-location driven calculator that allows users to determine maximum loan amounts by county and property type — enhancing transparency and user engagement.

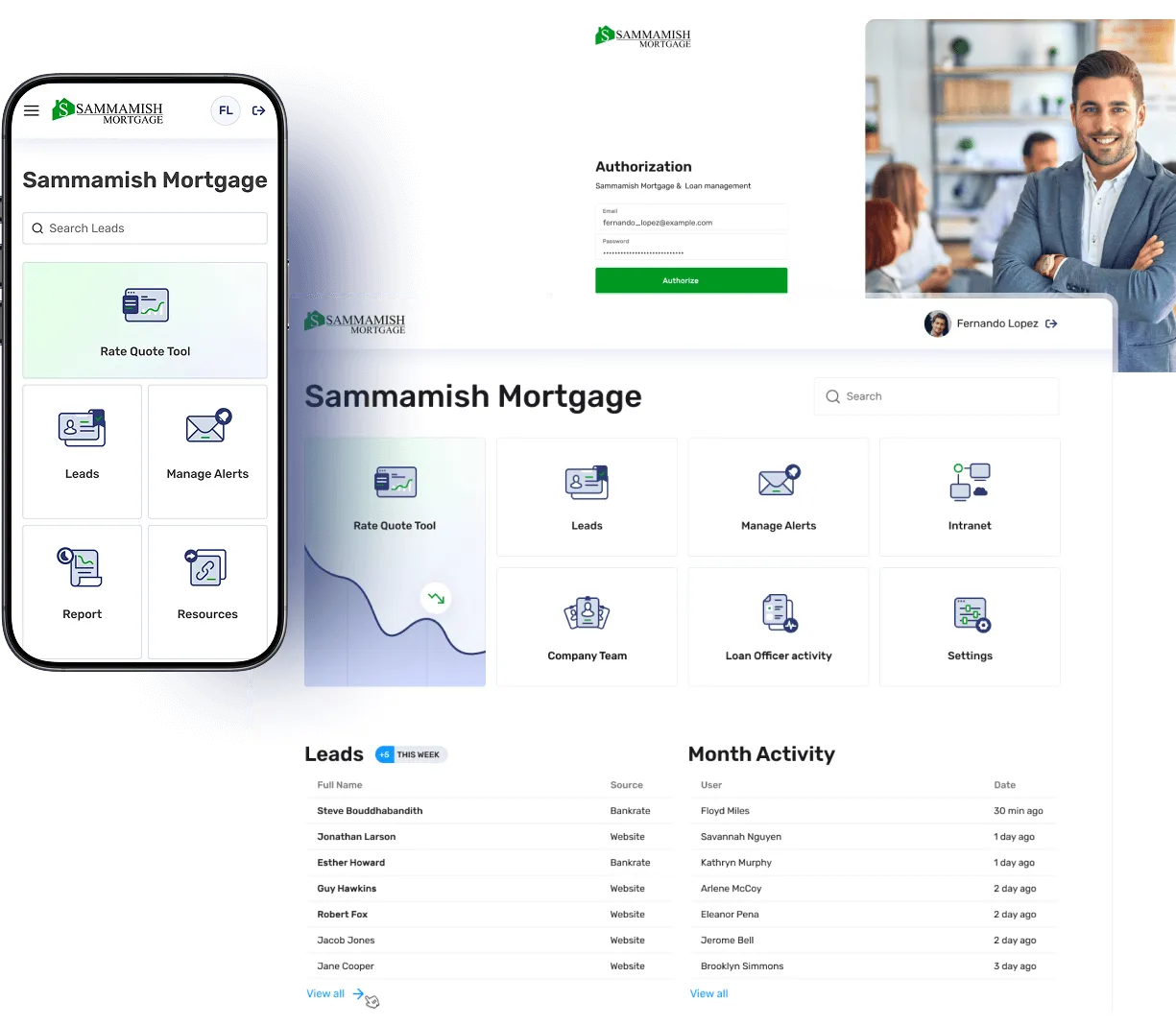

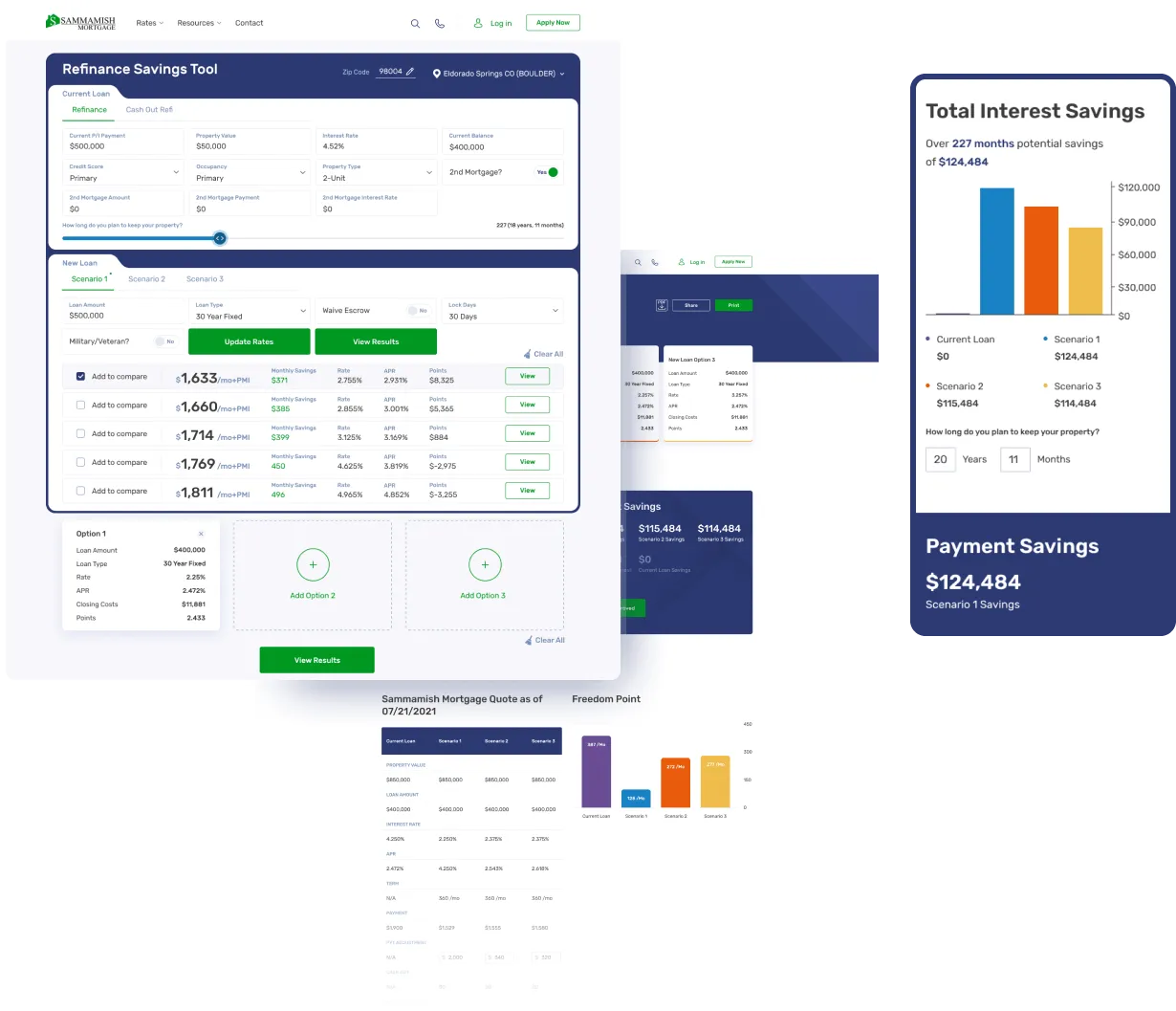

Flex Cost Mortgage

An internal platform built for loan officers, enabling real-time comparisons, pricing flexibility, and streamlined client workflows.